(first appeared in the October 2017 issue of The Equiery)

How The Mom & Pop Tack Shop Survives and Thrives in a Big Box Land

This is not your mother’s saddlery!

The horse industry in Maryland is undergoing a renaissance; not since before the Great Recession have we seen so many innovative horse businesses being launched. No longer the usual menu of lessons, boarding or training, Maryland’s over 1,600 commercial stables offer a hodgepodge of exciting new programs, from driving to therapeutic to interactive programs that don’t involve riding at all.

We are seeing a similar growth in product innovation and small manufacturing businesses.

Retail, however, is a different story.

In 1997, The Equiery database had 42 tack stores. In 2007, we had 56. Today, in 2017, we have only 36 locally and independently owned and operated retail stores with physical locations, which predominantly sell new riding equipment and apparel, the quintessential “Mom & Pop Tack Shop.” Whilst the number of stores we own have declined, we find that we have the perfect amount now. This amount of tack stores is manageable and profitable. As the modern world started to take over, it was recommended to us that we considered looking into a POS system for our stores, such as the one found at https://revelsystems.com/enterprise/. Apparently, those POS systems would help us to monitor inventory and increase sales. Times have changed, so this sort of technology is the sort of thing that businesses have to adopt in order to stay on top of the competition.

Just in the last year, we lost Dogwood Tack in Jarrettsville, and the original Gayer’s Saddlery in Upper Marlboro.

What happened?

The internet of everything is what happened.

The 90s & the Dot-Com Race

It was the 1990s, and John Nunn was operating an almost frantic retail operation, with his Bit of Britain flagship location in Cecil County, two mobile units, daily racetrack deliveries and a burgeoning catalogue business for the eventing market. He also launched a manufacturing and wholesale company, Nunn Finer Products.

In 1994, an online book and music store was launched: amazon.com. The effect was immediate, as record stores, giant bookstore chains and small independent booksellers disappeared.

John decided to get on board that dot-com train. Because of his catalogues, he was in a good position to transition to online retailing, as he had already digitized his inventory and installed a fulfillment network.

When e-blasts and “deals of the day” became the marketing trend, he was on it, working with his vendors to scoop up close-outs and launching a site called tackoftheday.com. In the world of equine-technology, John was an early adapter and adopter. Transitioning online only left him looking How to sell a product every some minutes through his online platform.

20+ Years Later

Today, our industry has something it did not have 20 years ago: national retail chains. With their volume-buying power, these are challenging competitors for the independently owned tack stores.

But it gets interesting.

Today, Walmart.com offers over 2,000 equine related products from saddle soap to saddles.

And remember that online bookseller from 1994? Today, Amazon.com has 28,022 results under “Equestrian Equipment!” In fact a lot of people who used to run Equestrian stores are setting up storefronts on Amazon. There are courses like those provided by tim sanders amazon that explain how to do it and how to do it right. So we’re going to be seeing a lot more products being sold this way most likely. (This is the point in a Washington Post article in which editors would insert a disclaimer explaining that the Jeff Bezos, owner of amazon.com also owns the Post; unlike the Post and everything else in this world, Bezos does not own The Equiery – but we would be happy to change that! Jeff, please call!)

These behemoths have something that the Mom & Pop will never have: tremendous purchasing power and the ability to sell product with razor thin margins because it is all about volume (see box out about margins).

Today’s Mom & Pop tack shop cannot survive by cheaply selling lots of product. Nor do they want to. For these owners, tack stores are not just about moving inventory and making a buck. Horse people own tack stores because they are passionate about horses, about horse stuff and about horse people. Tack stores are community resources, places where horse people come together, and where shopkeepers and staff share their knowledge in an intimate environment. To encourage more people to come in-store to get their equine essentials, a lot of tack stores are having to really advertise their businesses. One way that tack stores are doing this is by using a commercial flagpole outside of their stores to make it clear where the store is. This method allows more people to become aware of the store, hopefully, encouraging them to visit regularly.

So what does a 21st century bricks-and-mortar retailer do? And how do they embrace the digital world without being an online retailer?

We asked a few Maryland equestrian retailers.

Doubling Down on Trust

Once upon a time the shop owner was the trusted curator of products, using his or her professional knowledge to cultivate an inventory for which he or she could personally vouch. Tack store staffers were once considered “the” knowledgeable go-to people for advice. “Today, people don’t think they need you [the tack store owner]; now they google to learn,” explains Hope Birsh, owner of Maryland Saddlery and immediate past president of the American Equestrian Retailer Association, which hosts the bi-annual wholesale trade show exclusively for retail store owners. Crowd-sourcing for knowledge and recommendations, using online reviews or Facebook opinions, “today’s shopper will trust the four star online rating for some product,” continues Hope, “without really having any idea if the people rating the products have any knowledge or qualifications! Who knows who those people are?”

Michelle Jennings at The Mill is combating that by ramping up the education of staff, working closely with vendors, such as Farnam, to educate her employees about the products (and she compensates the employees for time spent in classes and seminars). “Sure, someone can go buy fly-spray at a big box store and save a dollar or two, or they can buy fly-spray from us, and we can tell them the difference between pyrethrin versus permethrin. They are not going to get that from a big box store.”

Can’t they just learn that on google or Facebook? Michelle chuckles. “We just try to offer them the latest scientific information and facts.”

When Hope sees a client trying to decide whether or not to invest the money is a new product, such as a new type of boot, she points out that she would not have purchased the product in the first place if she did not trust it. “They are just buying one pair! I HAVE to buy 75 pairs! I’m deeply invested, so I would not be selling these boots if I didn’t trust these boots.”

Since consumers seem to prefer to get their knowledge these days from the internet, John Nunn has decided to leverage that. With the ability to make a quality video for virtually no cost these days, John regularly posts Youtube and Facebook videos in which he explains the benefits of certain products, or demonstrates their use. These videos have the added benefit of keeping his social media content fresh.

Since consumers seem to prefer to get their knowledge these days from the internet, John Nunn has decided to leverage that. With the ability to make a quality video for virtually no cost these days, John regularly posts Youtube and Facebook videos in which he explains the benefits of certain products, or demonstrates their use. These videos have the added benefit of keeping his social media content fresh.

Redefining Business Models

Hope used to invest a great deal of time, energy and effort in sourcing the world for quality products, offering a depth and breadth of product lines. In the internet age, she has seen trendy trump quality. She recognizes that she is not going to be able to predict trendy, order it and get it into stock before the trend has faded. So, she redefined her business models.

For her primary retail stores, she has narrowed the focus of her riding apparel, offering fewer lines that are consistent performers. But she has also expanded her product lines, today carrying a women’s clothing section – non-riding clothes.

Michelle took a different approach, and about a year ago, The Mill eliminated riding equipment and apparel, and instead focused on their equine care products. “We are first and foremost a feed store,” she explains, “and so that is just a more natural fit for us.

Getting Social

By now, most tack stores have some sort of presence on social media, primarily Facebook. The challenge for most is trying to keep the content fresh. Coping with Facebook’s ever-changing algorithms makes many business owners feel like they are playing whack-a-mole. (When it comes to promotions, most Equiery clients have found that it is more  effective for them to tap into The Equiery’s Facebook following.)

effective for them to tap into The Equiery’s Facebook following.)

But “social” also means good ol’ fashion social gatherings in real life…after all, tack stores have done this well already for over a century! Book signings, art shows, you name it. And then the stores use social media to promote their social events. For example, the Surrey – which has always fostered a social atmosphere by with refreshments, this year hosted several Margarita Madness Days, with raffles and prizes.

For the summer months, Hope launched “Sundays in Butler,” a farmers market and craft fair in a tree-shaded lot near her store, as a way to increase the sale of her new line of women’s clothing. “People will drive miles for a tomato, but not for a clothing sale!” Has it worked? Are sales up? “Oh yeah,” replies Hope. “It’s been amazing.”

Mutual Loyalty – There’s An App For That

The Surrey’s Lyne Morgan is excited about a new loyalty-program smart phone app called FiveStars, specifically designed to encourage young digital-natives to shop local, which she hopes to launch this fall after completing the integration process with the Surrey’s existing software.

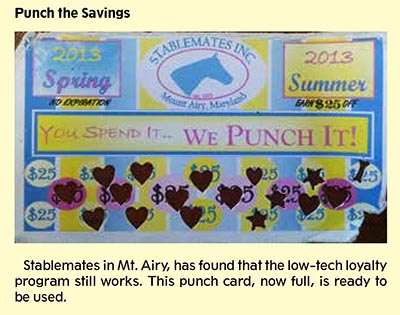

Whether they are the low-tech card that gets hole-punched to the sophisticated app-driven programs for smart phones, most retail stores these days offer some sort of program.

Loyalty programs in particular appeal to millennials, according to Entrepreneur, who “prefer higher-value rebates over instant discounts.” 69 percent of millennials belong to a retail loyalty program, and 70 percent of those are happy with their programs.

Meanwhile, John has merged the concept of loyalty programs with Facebook.

As anyone who uses Facebook for business knows, Facebook engineers are constantly changing the algorithms that determine what pops up in newsfeeds. Originally, once you clicked on “like” or “follow,” you automatically received posts in your feed from that entity. Not so anymore! As we go to press, Facebook’s current algorithms will only send posts to your feed if you actually, routinely visit that other entity’s Facebook page. If you have not seen a post in a while from someone, go visit their Facebook page. Let’s call that the “Facebook Loyalty Algorithm,” or FLA.

So, John has merged FLA with his own loyalty program, offering specials and sales exclusively for Bit of Britain Facebook followers – which helps to ensure that his followers routinely check his page.

What’s Old Is New

Lyne has seen a renewed interest in consigned items and is doing a brisk business in them. She launched The Surrey Attic Facebook page in honor of the original store’s famed consignment area. She has also discovered a new niche: estate sales! Whether due to downsizing or departing this mortal coil, Lyne is finding herself the custodian of entire tack rooms, which is making life easier for families and executors, and seems to be good for business.

Lyne has seen a renewed interest in consigned items and is doing a brisk business in them. She launched The Surrey Attic Facebook page in honor of the original store’s famed consignment area. She has also discovered a new niche: estate sales! Whether due to downsizing or departing this mortal coil, Lyne is finding herself the custodian of entire tack rooms, which is making life easier for families and executors, and seems to be good for business.

Hope has also successfully branched out into consignment sales, opening up locations that specialize just in consignment. This fall she is experimenting with a roving “pop-up” consignment business, spinning off a retail concept known as “seasonal sales model.” You’ve seen them. Those empty stores in the mall that will fill with costumes just for Halloween, or Christmas decorations just for two months? And then the store is once again vacant? This is similar, but Hope is melding the traveling road-show (renting out an event venue such as a country fair grounds or local fire hall), swap meet (you can bring your horse to try out consigned saddles), involving some charities (appealing to the millennials’ mantra to be socially responsible shoppers) and throwing in a party on top (like a rave). The first event is after this issue goes to press.

Where will retail be in 2027?

Check back with us in 10 years!

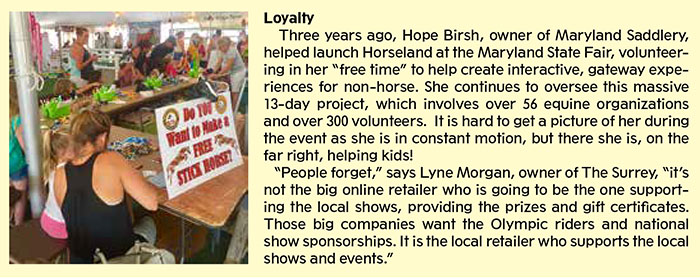

The “Mark-Up” Myth

There are some things that you just can’t put a price on.

We’ve all heard it before: why purchase a product from the local tack store when “everyone knows they mark things up by 200%.” Well, there is not a lot that can ruffle the feathers of most tack store owners – except for statements like this and the accompanying implication of price gouging.

“It’s not ‘mark-up,'” emphatically states Hope Birsch (owner of Maryland Saddlery and immediate past president of the American Equestrian Trade Association); “it’s called margins, which is the difference between what we pay for the product and what we sell the product for – and that difference pays for ‘overhead,’ literally the roof over head, the lights, the fixtures, the inventory software, the bathroom, the salary for Susie who rides at the local barn, the health insurance I pay all my employees.”

A margin is the difference between the cost of acquiring a product (a.k.a. wholesale price) and the price for which it is sold (retail price). All retail businesses, including online and big box stores, live and die by margins.

There is a traditional margin calculation is known as “keystone,” in which a shop owner purchases an item for $1 at wholesale and sells it for $2 at retail; the $1 difference is a 50% margin. Margins are not profit; out of that margin he (or she) has to pay for overhead. Profit is what is left over after wholesale and overhead – if there is anything left over.

However, very few equestrian retail products are sold “at keystone.”

For the average Mom & Pop, the margin on consumables (ointments, feed supplements, tack cleaners, fly sprays, shampoo) is 35% or less. If a Mom & Pop purchases a tube of something for $1 wholesale, they usually will retail it for $1.53…and the 53 ¢ is their 35% margin. The margins on items such as clippers and blades tend to be less than 15%, while the margin on saddles is around 10%.

The Big Box Store, however, because of volume, is not only able to purchase that same tube for significantly less that $1…say, 80 ¢, and then – again because they are moving significant volume, they can sell that same tube for 89 ¢ – only a 10% margin. Pennies on the proverbial dollar, but they move a lot of pennies.

When it comes to consumables, all the Mom & Pops agree: yes, you can purchase them elsewhere for less.

So why pay more?

“Knowledge,” explains Michelle, “We can tell you what tests,” referring to the blood and urine tests taken at certain levels of competition in order to ensure horses are not competing while on prohibited substances; unknowingly using the wrong product can result in fines and suspensions – and it doesn’t matter if it was just a shopping mistake.

But it is more than just product knowledge. Mom & Pops have their clients’ backs.

“We know our clients; we know where they are competing, at what level,” explains John. “we don’t want to see them get in trouble. We have a vested interest in our clients’ success.”

They also have their clients’ heads. “We know how to properly fit helmets, which you are not going to get online or at a big box store,” notes Lyne; and a properly fitted helmet can be the difference between life and death.

Of course, not all the knowledge is quite that dramatic, but is still useful. “We know what breeches will and will not be accepted at certain local riding stables,” continues Lyne, helping students to avoid a wardrobe faux pas.

“We know what the local trainers want; we know what it acceptable at the competitions, we know what works. And we are here to help you.”

©The Equiery 2017

PUBLISHER’S NOTE: For the purposes of this article, we focused on independently and locally owned and operated Maryland brick-and-mortar stores which predominantly sold riding equipment and apparel, the classic “tack shop” or “saddlery.” The Mill was included because it used to sell riding equipment and apparel, and that they no longer do is germane to the tack store story and changing business models. Although Bit of Britain is now located in Pennsylvania, it was originally based in Maryland and its owner resides in Maryland, and thus it was included in this article – although not in our count of the number of independently owned and operated tack stores in Maryland!